How much do you need to save for a comfortable retirement?

It’s a big question, and you’ll often hear dire warnings you don’t have enough.

But for most Australians, it’s a lot less than you might think.

You spend less in retirement

Australians tend to overestimate how much they need in retirement.

Retirees don’t have work-related expenses and have more time to do things for themselves.

And retirees, especially pensioners, benefit from discounts on council rates, electricity, medicines, and other benefits worth thousands of dollars a year.

While housing is becoming less affordable, most retirees own their own home and have paid it off by the time they retire.

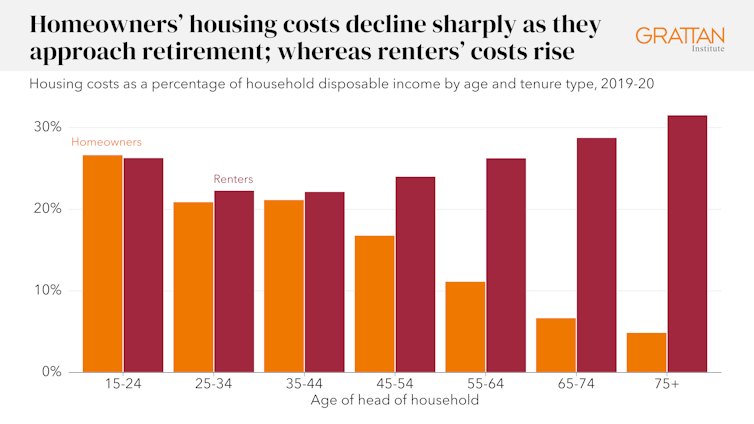

Australians who own their home spend an average of 20–25% of their income on housing while working, largely to pay the mortgage.

But that falls to just 5% among retiree homeowners, because they are just left with smaller things such as rates and insurance.

Grattan analysis of ABS (2022) Survey of Income and Housing.

And whatever the income you need at the start of your retirement, it typically falls as you age.

Retirees tend to spend 15–20% less at age 90 than they do at age 70, after adjusting for inflation, as their health deteriorates and their discretionary spending falls.

Most of their health and aged-care costs are covered by government.

So how much superannuation do you need?

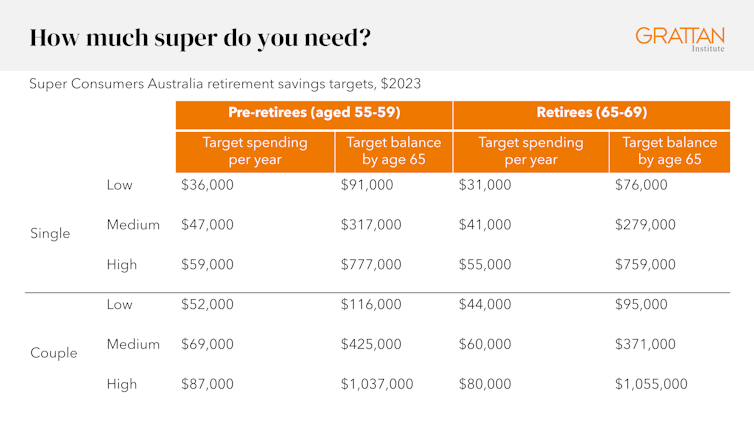

Consumer group Super Consumers Australia has crunched the numbers on retiree spending and presents three robust “budget standards”:

- a “low” standard (that is, enough for a person who wants to spend more than what 30% of retirees do)

- a “medium” standard (spending more than 50% of retirees do), and

- a “high” standard (more than 70%).

Super Consumers Australia (2023) Retirement Savings Targets

Crucially, these estimates account for the significant role of the Age Pension in the retirement income of many Australians. The maximum Age Pension is now A$30,000 a year for singles, and $45,000 a year for couples.

To meet Super Consumers Australia’s “medium” retirement standard, a single homeowner needs to have saved only $279,000 in super by age 65 to be able to spend $41,000 a year. A couple needs only $371,000 in super between them to spend $60,000 a year.

To meet their “low” standard – which still enables you to spend more than 30% of retirees – single Australians need $76,000 in super at retirement, and couples $95,000 (while also qualifying for a full Age Pension of $30,000 a year).

That’s provided that you own your own home (more on that later).

Ignore the super lobby’s estimates

Australians should ignore the retirement standards produced by super lobby group the Association of Superannuation Funds of Australia.

Their “comfortable” standard assumes retirees need an annual income of $52,085 as a single, and $73,337 as a couple. This would require a super balance of $595,000 for a single person, and $690,000 for a couple.

But this is a standard of living most Australians don’t have before retirement.

It is higher than what 80% of single working Australians, and 70% of couples, spend today.

For most Australians, saving enough to meet the super lobby’s “comfortable” standard in retirement can only come by being uncomfortable during their working life.

Most Australians are on track for a comfortable retirement

The good news is most Australians are on track.

The federal government’s 2020 Retirement Income Review concludes most future Australian retirees can expect an adequate retirement, replacing a more-than-reasonable share of their pre-retirement earnings – more than the 65–75% benchmark nominated by the review.

Even most Australians who work part-time or have broken work histories will hit this benchmark.

Most retirees today feel more comfortable financially than younger Australians. And typically, they have enough money to sustain the same, or a higher, living standard in retirement than they had when working.

Rising mortgage debt doesn’t change this story

More Australians are retiring with mortgage debt – about 13% of over-65s had a mortgage in 2019–20, up from 4% in 2002–03.

But the government’s retirement income review found most retirees who used $100,000 of their super to pay off the mortgage when they retire would still have an adequate retirement income.

This is, in part, because many would qualify for more Age Pension after using a big chunk of super to pay off the mortgage.

And retirees can get a loan via the government’s Home Equity Access Scheme to draw equity out of their home up to a maximum value of 150% of the Age Pension, or $45,000 a year, irrespective of how much Age Pension you are eligible for.

The outstanding debt accrues with interest, which the government recovers when the property is sold, or from the borrower’s estate when they die, reducing the size of the inheritance that goes to the kids.

But what about renters?

One group of Australians is not on track for a comfortable retirement: those who don’t own a home and must keep paying rent in retirement.

Nearly half of retired renters live in poverty today.

Most Australians approaching retirement own their own homes today, but fewer will do so in future.

Among the poorest 40% of 45–54-year-olds, just 53% own their home today, down from 71% four decades ago.

But a single retiree renting a unit for $330 a week – cheaper than 80% of the one-bedroom units across all capital cities – would need an extra $200,000 in super, in addition to Commonwealth Rent Assistance (according to the government’s Money Smart Retirement Planner).

This is why raising Commonwealth Rent Assistance to help renting retirees keep a roof over their heads should be an urgent priority for the federal government.

Australians have been told for decades that they’re not saving enough for retirement. But the vast majority of retirees today and in future are likely to be financially comfortable.![]()

Brendan Coates, Program Director, Economic Policy, Grattan Institute and Joey Moloney, Deputy Program Director, Housing and Economic Security, Grattan Institute

This article is republished from The Conversation under a Creative Commons license. Read the original article.